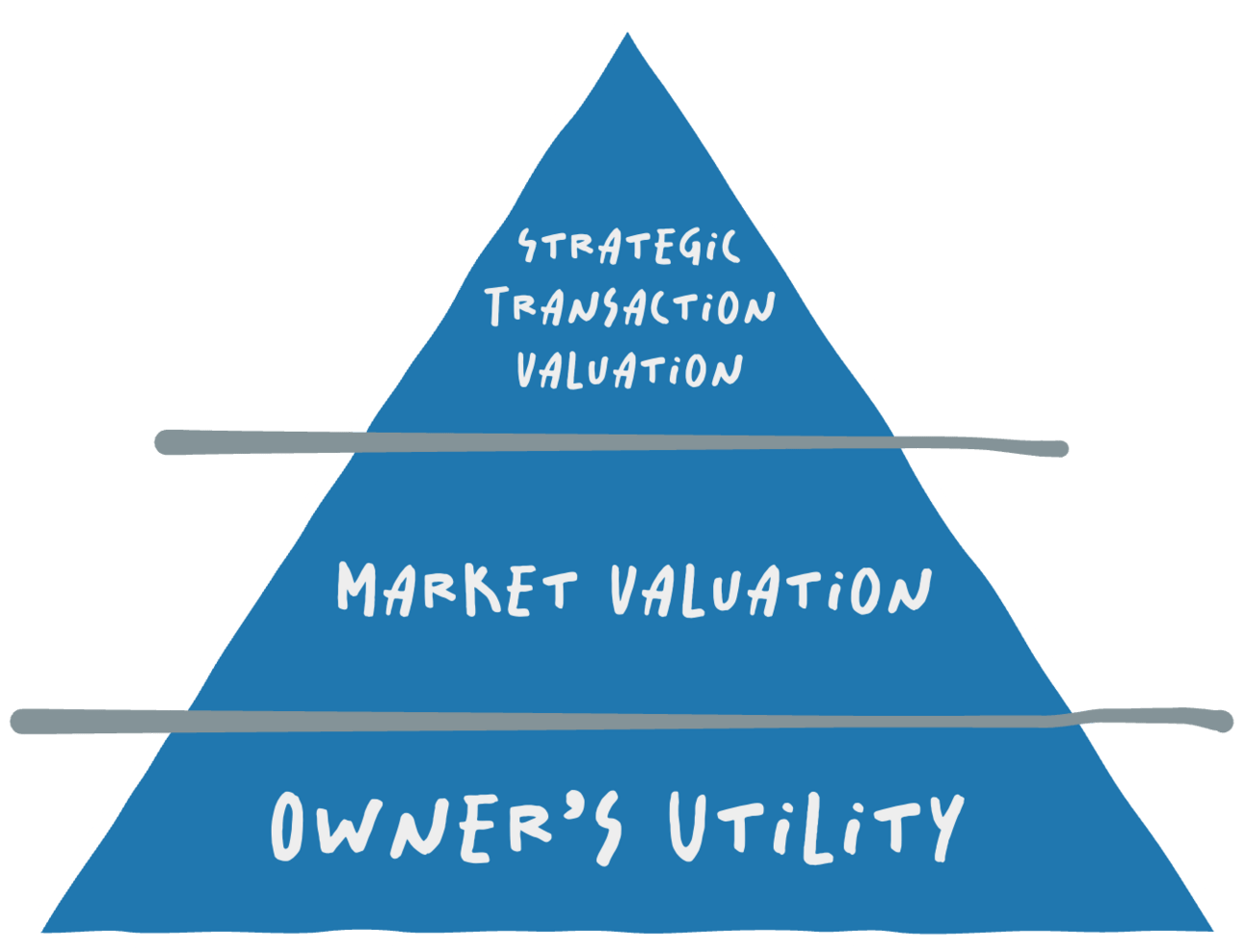

TL;DR – Part 1: Most business owners want to know what their company is worth—but fear that asking will trigger a feeding frenzy of advisors, brokers, and buyers trying to steer the outcome. This article reframes business valuation as a lens, not a number, helping owners see their company through three distinct perspectives:

Owner’s Utility Value — What the business is worth to you, based on your goals of time, income, and wealth.

Market Valuation — What it’s worth to a financially motivated buyer, based on normalized cash flow and risk.

Strategic Transaction Value — What it’s worth in a real deal, to a specific buyer, under real terms.

Together, these lenses give you the clarity to lead like an investor—aligning your business with your life, your strategy, and your future (whether you sell or not).

📚 Estimated Read Time: 7–9 minutes

Table of Contents

1. Why Business Valuations Matter (Even If You’re Not Selling)

“I want to know what my company is worth in the market… but I don’t want to sell.”

Most owners I know are deeply curious about what their company is worth, but don’t want to ask the question out loud.

Because the moment you float it, "What’s my business worth?" it’s like blood in the water.

Suddenly, the professionals swarm.

The consultant, now rebranded as an “Exit Planner,” can’t wait to get involved.

The wealth manager is salivating at your liquidity event.

The private equity guys tell you you’re amazing, right before submitting a lowball LOI.

The banker wants to lend against your future proceeds.

The broker or investment banker dangles stories of dream exits.

The attorney drafts a term sheet before you’ve even decided what you want.

And somewhere in that flood of noise, you—the owner—realize you’re not in control of the conversation anymore.

You asked a simple question.

And now the deal train is leaving the station…

…and you’re not even sure you want to be on it.

The Real Problem

Most owners didn’t go to school for finance.

They built something in the real world — in a specific industry, through hard-earned experience.

We want to know what our business is worth.

We just don’t want to get sold something, or talked into a direction we didn’t choose.

And when we do try to find answers, we hit a wall:

Financial people talk in spreadsheets.

Online articles contradict each other.

Buyers are vague or overly flattering.

Most of the real insights live behind paywalls, pitch decks, or broker relationships.

Even worse? Many of the advisors involved in valuation work don’t understand what it’s like to actually own a company.

They haven’t missed payroll.

They haven’t had a key customer cancel.

They haven’t put their family’s future on the line to fund growth.

They’re managing spreadsheets. You’re managing people, pressure, and tradeoffs.

That’s what makes business valuations so frustrating—

They feel abstract. They feel disconnected.

Like the healthcare system: bills arrive with no transparency, codes you can’t decipher, and no way to know the “real” cost. Owners face the same problem with business value — an opaque system that leaves you guessing, floundering, and making gut calls instead of leading with clarity.

That’s why so many of us end up running our companies by instinct — the “stomach ache test.”

The Red Pill of Ownership

Here’s the shift: valuation isn’t just a number you get when you sell. It’s a lens you can use every day to measure progress toward your own goals.

And that matters right now — because every major decision you make (reinvestment, distributions, hiring, debt, growth) is a valuation decision in disguise. Without clarity, you’re flying blind.

Once you see this, you can’t unsee it. It’s like swallowing the red pill in The Matrix. Suddenly, you realize why so many of your past decisions felt disconnected. You weren’t crazy — the system was.

Valuation clarity is ownership power. And it starts with understanding the three lenses.

2. Business Valuation Is a Lens, Not a Number

The Truth: You’re Not Crazy. The System Is.

There’s no common language for business value.

Buyers, bankers, brokers, and owners all look at the same business—and see something different. They use different models. Different tools. Different timelines. They’re all optimizing for their definition of value.

That’s why two buyers can look at the same company and come back with valuations millions of dollars apart.

It’s not personal. It’s not a trick. It’s perspective.

If you don’t understand those perspectives, you’ll feel like the crazy one.

Most owners think valuation is a single number.

“What’s it worth?”

They expect a clean answer—maybe it’s $2.3 million. Or 5× EBITDA. Or whatever a broker tosses out at an industry event.

But that number, on its own, is meaningless without context.

Because valuation isn’t a number. It’s a lens.

The Lens Shift

The better way to think about valuation is as a lens. Each lens gives you a different perspective on the same company:

One lens shows what the business is worth to you as the owner.

Another lens shows what the market would pay.

A third lens shows what a specific buyer might pay in a specific deal.

Once you see the game this way, you can’t unsee it. It’s the red pill of ownership: suddenly, the noise makes sense. You realize why advisors, brokers, bankers, and private equity all tell different stories. They’re not lying—they’re looking through different lenses.

Subjective—But Not Unknowable

There’s a reason we say, “value is in the eye of the beholder.”

Yes, a bottle of water might cost $3 in the city and $3,000 in the desert—but it still has a measurable volume, container, and chemical makeup.

In other words, value is subjective—but not unknowable.

Every functioning market works this way. Real estate, stocks, and bonds—they all have observable fundamentals. Buyers and sellers apply their own filters—return expectations, risk tolerance, strategic intent—to determine what something is worth to them.

Privately held businesses are no different.

The Real Challenge

There’s no Bloomberg terminal for your company. No daily ticker. No standardized comps. No real-time signal telling you what it’s worth—or why.

As Brent Beshore puts it, it’s a messy marketplace.

Valuations are passed around like hearsay—between brokers, buyers, CPAs, and advisors—using wildly different models, assumptions, and incentives.

The Path Forward

This article is here to change that.

We’re not chasing a single, “true” valuation.

We’re introducing a clear, simple framework: three lenses that help you evaluate your company

3. The Three Lenses of Business Valuation (And Why They Matter to You)

Most owners think of business valuation as a single number. “What’s my company worth?”

But as you now know, that question is layered. There’s no single, universal answer—because value depends on who’s asking, why, and how they define worth.

That’s why we built this framework: Three Lenses of Business Valuation. Each lens gives you a different, essential view of your company—based on your goals, the market’s perspective, and what happens in an actual deal

Understanding all three is what separates owners who guess from owners who lead.

Understanding all three is what separates owners who guess from owners who lead.

This is your personal lens.

It’s not about what a buyer would pay. It’s about what the business delivers to you: your time, your income, and your long-term wealth.

This lens forces you to answer questions like:

How involved am I in daily operations?

How much cash do I actually take home?

Could I maintain my income if I sold?

Is this business creating transferable real wealth, or just funding my lifestyle?

By clarifying what the business needs to deliver in time, cash, and equity, you stop chasing arbitrary growth and start aligning strategy with your life.

Without this lens, it’s easy to fall into one of two traps:

Growth for growth’s sake — reinvesting endlessly, hoping freedom shows up later

The entitlement trap — extracting income now, while starving long-term value

This is your personal ROI benchmark. It’s the lens that keeps your business serving you—not the other way around.

This is the objective lens.

It strips away emotion and looks at your company as an asset—based on four key drivers that professional buyers use in nearly every deal:

Normalized EBITDA — ustainable cash flow, after one-time noise.

Valuation Multiple — shorthand for risk: how confident is the market in your future cash flow?

Net Debt — Cash-free debt-free company at closing. You get to keep your cash, and you need to pay off debt at any closing.

Normalized Working Capital — the cash tied up in operations to keep the machine running

Together, these create the formula:

Together, these create the formula:

EBITDA × Multiple = Enterprise Value

Enterprise Value – Net Debt = Equity Value

→ Subject to Working Capital True-Up at Close

Note on Working Capital: In most deals, you’re expected to deliver a normalized level of working capital—typically based on a trailing 12-month average.

This ensures the buyer receives a functioning business with enough short-term assets (like A/R and inventory) to operate normally.

The purchase price is adjusted up or down depending on whether you deliver more or less than the agreed target.

Working capital is not subtracted like debt—only the difference from the target is.

This lens gives you clarity on what your business is likely worth today, in a fair-market transaction with a financially motivated buyer.

Whether or not you ever sell, you should know this number.

Why?

Because it lets you:

Benchmark your value in the market, regardless of the buyer

Spot gaps between perceived and actual value

Measure ROI on strategic decisions

Creates confidence when you have to make important decisions

It’s the investor’s lens. Every serious capital allocator knows this formula. You should too.

This is the situational lens.

It’s not a generic market formula, it’s what a specific buyer might pay in a specific deal, based on:

Their ownership structure (e.g., private equity, strategic buyer, ESOP, family office, etc.)

Their investment goals and return expectations

Their strategic reason for the acquisition

The actual deal terms (cash at close, seller notes, earnouts, taxes, fees, etc.)

This lens reveals the real-world outcome of a transaction—including:

How much cash you actually take home (net of taxes and fees)

What role you’ll play post-sale (if any)

What happens to your team, brand, and legacy

Whether the structure aligns with your values and goals

Without this lens, owners often get surprised at closing—or worse, regret a deal that didn’t get them what they really wanted.

This is where everything comes together: your goals, the market’s view, and the buyer’s structure.

4. Why the Three Lenses Matter (Even If You’re Not Selling)

Clarity Is Power

Valuation isn’t just about selling someday. It’s the scoreboard that shows whether your business is delivering what you want today.

Without clarity, every major decision—hiring, reinvestment, distributions, debt—is really a valuation decision in disguise. If you don’t see it that way, you’re left making gut calls and hoping for the best.

With clarity, you can finally see how each choice impacts your time, cash flow, and wealth.

The Owner’s Advantage

Most advisors see only one lens. Bankers focus on collateral. Brokers push multiples. Buyers look at their ROI.

But when you understand all three lenses, you get the whole picture. You can:

Lead with confidence instead of reacting.

Align your strategy with your life, not just revenue goals.

Spot gaps before they turn into regrets.

Play the long game without getting lost in the noise.

Your Next Step

Each lens builds on the others. First, we’ll go deeper into the Owner’s Utility Value—what your business is worth to you in time, income, and wealth. Then we’ll explore the Market Valuation and the Strategic Transaction Value.

Because clarity on value isn’t about an exit.

It’s about building independence by design—today, not someday.