The Ownership Dream

You didn’t start your business for the title. You started it for the freedom.

The freedom to control your time

To build something meaningful

And take care of your family and your team

You took the risk.

You made the sacrifices.

And you kept going when most people would’ve walked away.

Because this isn’t just a business.

It’s your passion.

Your identity.

Your money.

You’re the one people count on. The buck stops with you.

You decide where the money goes, what gets prioritized, and what gets delayed.

You’re the one carrying the weight no one else sees.

Not just the financial pressure, the emotional pressure.

Tradeoffs between growth and family

Conflict with partners, co-owners, or yourself

The feeling that you’re the only one thinking about the big picture

It’s heavy.

It’s lonely.

And it’s hard to find others to talk to who “get it”.

But you keep going — not out of duty, but because you believe in the dream.

That one day, the business will run without you.

That your ownership distributions will fund your lifestyle.

You still be involved, but on your terms.

You’ll have the option to keep the business or sell it.

To design a life that would make all the risks worth it.

That’s what ownership independence looks like:

Control over your time

Predictable cash flow

And wealth that gives you real choices

For most owners, that vision of independence feels just out of reach.

You know what you want.

But the path to get there still feels murky.

Your cash flow isn’t as predictable as it needs to be

Your reinvestments feel risky or reactive

You’re still more involved in operations than you’d like

You’re making progress, but it's hard to see the end goal.

But, when you step back to ask the bigger question, how can the business help me achieve my goals, there’s no clear answer:

Should I grow? And how fast?

How much money can I take out of the business?

What’s the company worth?

Should I take some chips off the table?

What would it take to step back and still benefit from what I’ve built?

These aren’t casual questions.

They’re deeply personal.

These questions are not just about the business.

They’re about your time. Your money. Your family. Your future.

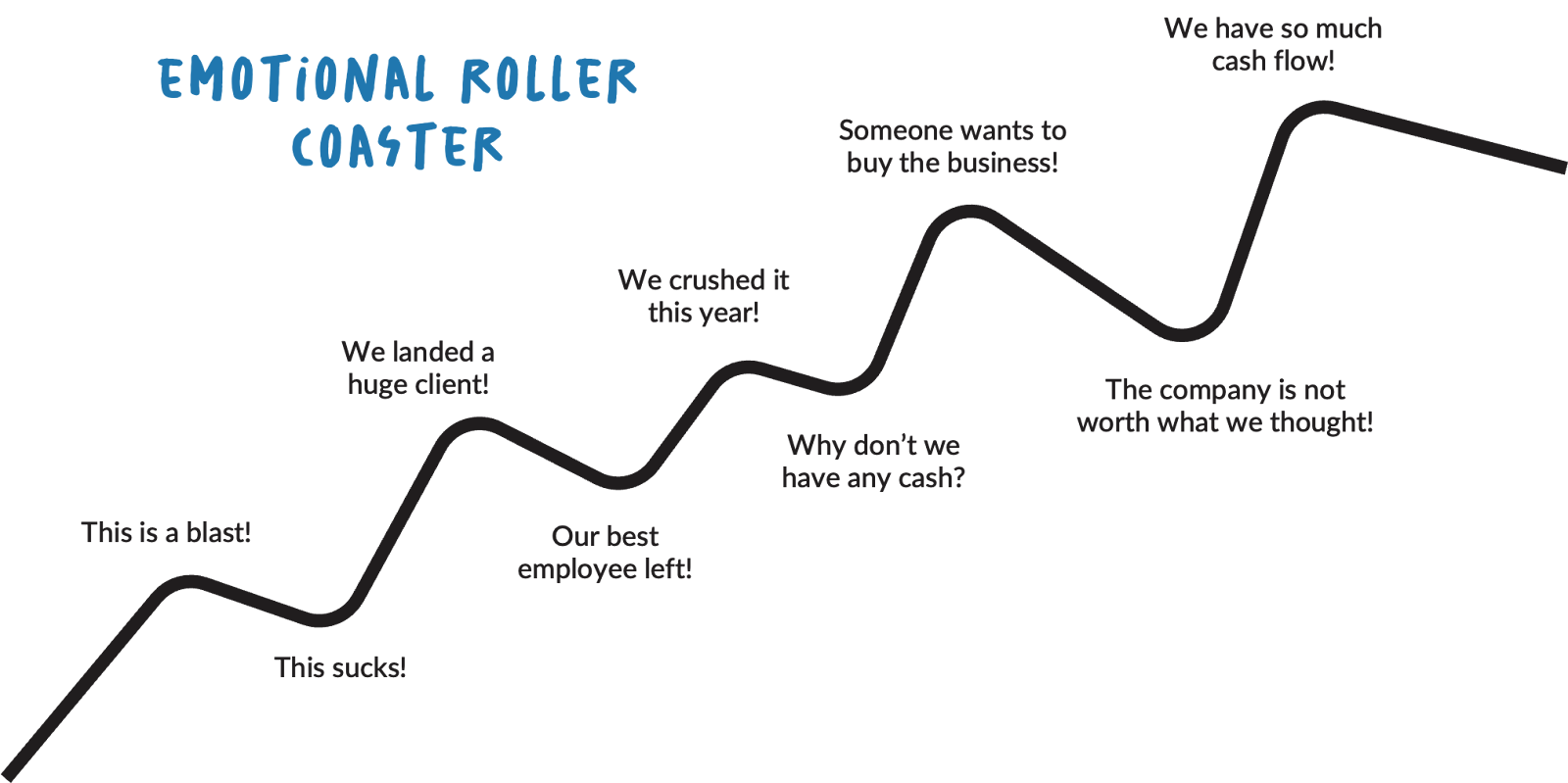

It’s exhausting and becomes an emotional rollercoaster when you can’t clearly see the path forward.

So you do what most owners do:

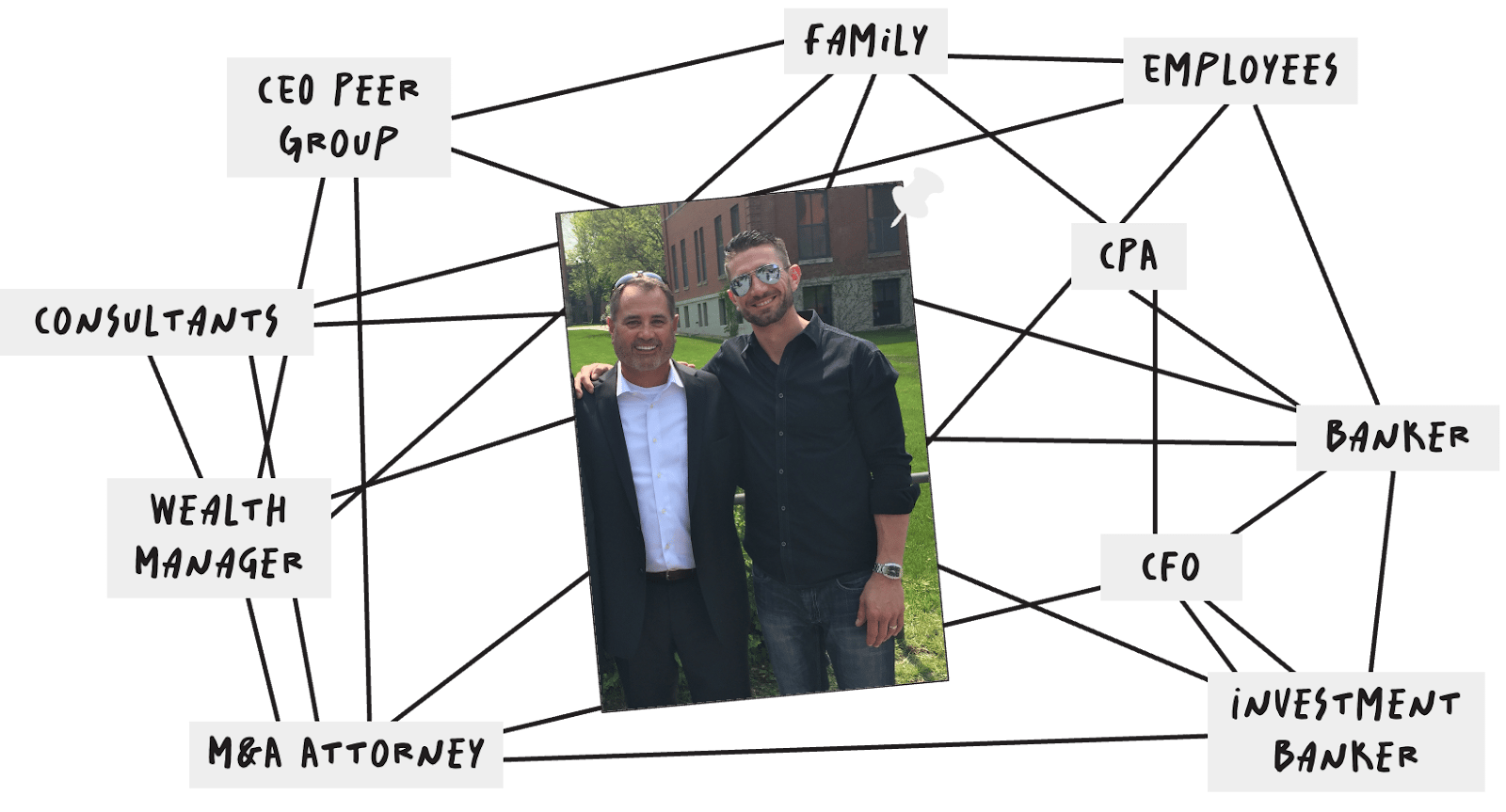

You start floating the questions to advisors — your CPA, wealth manager, attorney, banker, operational consultant, but everyone has their own playbook:

EOS©

Exit planning

Value growth

Scaling Up

Succession

Strategic planning

Tax optimization

Wealth management

Everyone has a model.

Everyone has advice.

But no one’s looking at the full picture.

You get pulled in different directions — each one solving for a specific piece of the puzzle, but none of them seems to solve the root issue.

And eventually, you realize:

The issue isn’t a lack of strategy. It’s that the strategies aren’t integrated into a holistic plan.

You’ve got a business to run.

A family to support.

And a future to design.

But no one’s helping you build a system that brings those things together.

That’s when it hits you: there’s no playbook for the owner.

Therein lies the challenge…

My Story: I learned this stuff the hard way.

I learned it from being in the trenches with my dad, turning around our $21M business that lost almost a million dollars in 2009, and selling it in 2014 for eight figures.

My dad had built a very successful business after barely graduating from high school.

In the early 2000s, the office equipment dealer business was kicking off a bunch of cash, and he stepped back and took his eye off the ball to deal with a bunch of personal stuff.

When I joined full-time in 2009, I was in my twenties—naive, wide-eyed, and all-in.

I poured everything I had into saving the family business. My dad’s legacy, and what I hoped would someday be mine.

We rebuilt the company from the ground up.

The mission was clear: hit our $240,000 payroll every other week and keep the machine going.

We sold two branches for cash.

Implemented new accounting and ERP systems.

Built out the document management and managed IT service offerings.

By the time I was twenty-five, I had fired close to 50 people. I read the book Zappos, Delivering Happiness, and created a culture that I thought was magical.

After five of the hardest years of my life, we clawed our way back to health:

→ A solid team

→ A profitable operation

→ A normalized seven-figure EBITDA

But the tension hadn’t gone away.

It had just changed.

My dad wanted out. I wanted to double down.

Same business.

Two people.

Two different goals.

And all our cash flow and wealth were trapped inside the same machine.

We did everything we could to find alignment — CPAs, consultants, attorneys, bankers.

But the more advice we got, the more disconnected it all felt.

Everyone had an opinion. No one had a framework. And no one was helping us align as owners.

So we stayed stuck in the fog — growing, debating, guessing.

Eventually, we hit a wall.

We couldn’t agree on how to reinvest.

We couldn’t agree on how to take distributions.

We couldn’t agree on how to step back.

The pressure never let up. And we were exhausted.

So we sold.

We got a good price.

A strategic buyer.

A deal structure that maximized our valuation.

Enough to pay off debt, cover taxes, allow my dad to retire, and leave me with a nice chunk of cash at the age of 27.

But it came at a cost. The culture, systems, and team we’d built were gutted overnight.

To hit the number, we had to sell to a buyer who didn’t need the back office, just the customer contracts and a skeleton crew of our employees.

Out of our 90 employees, only 34 went with the sale.

All the sacrifices.

All the progress.

All the things we’d built — gone with a bank wire.

I went home and bawled my eyes out.

I wasn’t even supposed to have a job as part of the deal. I was an “add-back” — just a line item on the spreadsheet.

The buyer was nice enough to offer me a position, but it didn’t take me long to realize: I’m professionally unemployable.

I lasted less than 90 days.

That sale was supposed to be the finish line.

But it didn’t feel like a win.

I had given up something I loved. I felt like a part of me was gone. My entire life was entangled with the business.

My identity.

My income.

My future wealth.

We didn’t fail because we didn’t make enough money on the sale. I felt we had failed because I thought I got the rug pulled out from under me, and there should have been a different way.

I didn’t need another spreadsheet.

Another opinion.

Another half-baked plan that only told part of the story.

I needed a way to see the full picture.

A framework to clarify our personal goals.

Lay out our options.

See the tradeoffs and navigate the complexity with confidence.

We were stuck — not because we didn’t care, or weren’t smart, or weren’t willing to do the work.

We were stuck because we were trapped inside a business and didn’t have a playbook to align our operations with our ownership goals.

All of the consultants and advisors we engaged were trained to solve one piece of the puzzle. Each had their own take from their technical perspective, many of whom had never owned or run a business before.

The banker wanted to make loans

The CPA did our audit and looked at taxes (barely)

The abundance of consultants we worked with wanted more fees

The investment banker wanted to sell the business for the highest purchase price

We didn’t have a wealth manager because all our wealth was tied to the business and building

Our corporate counsel was focused on buy/sell agreements and legal risk

Our estate attorney was giddy to design elaborate trusts

Everyone’s solving for something.

But no one has a grasp of the whole thing.

So we joined Vistage, a CEO peer group. There, we meet other owners who were in the trenches like us. However, they also lacked a clear master plan. It was a lot of random advice from owners who all had various degrees of success, all unique in their own way, which made it impossible to reverse engineer what they were doing or what worked.

No one had a comprehensive playbook. Everyone was solving problems, but no one was asking the most important questions:

→ What do you want?

→ What tradeoffs are you willing to make?

→ What options exist — and what would they really mean in relation to your goals?

We needed a way to align our operations with our goals. To step back from the chaos. To zoom out and design a path that aligned both our goals, not just the business’s growth.

But that system didn’t exist.

So after we sold, I spent the next decade trying to build it.

I launched a podcast.

Interviewed 450+ owners, buyers, authors, and the top thought leaders.

Facilitated dozens of transitions.

Started a couple of businesses.

Walked thousands of owners through my workshops.

And I kept seeing the same pattern.

No matter how successful the business appeared on the surface, I found most owners were still trapped and hadn’t reached their full potential or true independence.

→ Making gut-based decisions without clear ownership goals

→ Juggling unpredictable cash flow

→ Stuck in the daily operations

Owners were growing revenue, but never achieving real freedom. That’s why I created the Independence by Design™ Framework.

Not another operating system.

Not to promise a quick fix.

But to give owners what I wish we’d had: A structured playbook to clarify ownership goals, weigh options, make good decisions, and clarify a path to independence.

It’s a playbook for you, the owner.

Next, you can dive into what I think has most owners stuck, it’s called the Owner-Operator Trap, or you can jump straight to the Independence by Design™ Framework overview.