Your Ownership Scorecard — Time, Cash Flow, Wealth

You’d never run your company without a scoreboard.

So why are you running your ownership without one?

Most owners track revenue, margin, maybe EBITDA — but those metrics don’t tell you:

How free you are

How close are you to your real goals

Or whether the business is compounding your life, or consuming it

That’s why I built the iBD Owner’s Scorecard.

What the Scorecard Measures

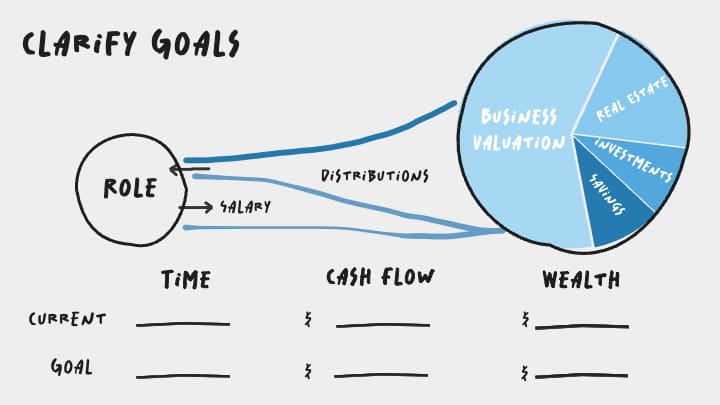

The Scorecard tracks your progress across three dimensions that define Owner Independence:

Dimension | What It Tells You |

Time | Are you spending your time where it matters most — and on your terms? |

Cash Flow | Is your income predictable, strategic, and aligned with your lifestyle needs? |

Wealth | Are you building real equity and enterprise value that serves your future? |

Each includes:

Your Current State (where you are)

Your Future Goal (what you want)

Your Progress % (how far you’ve come)

Together, these create a weighted iBD Score — a single number that reflects how close you are to true Owner Independence.

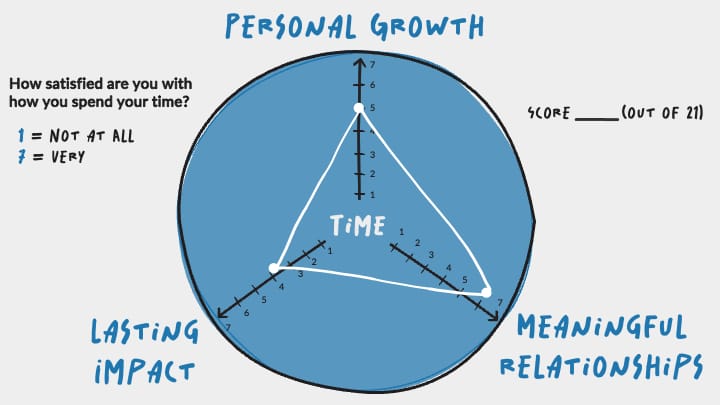

Time: The Most Important Metric

We weight Time at 50% of your Score — because it’s your most limited, most emotional, and least renewable resource.

This isn’t just about time off.

It’s about whether you’re using your time for what matters most.

Because if you had total control over your calendar — what would you do with it?

Time is the foundation of freedom. And ultimately, you’ll measure its quality by how much it contributes to:

Personal Growth → Are you becoming the person you want to be? Are you evolving as a leader, creator, parent, partner, human?

Meaningful Relationships → Are you spending time with the people who matter — not just reacting to the needs of others?

Lasting Impact → Are you using your time to build something that will outlive your calendar? Something that reflects your values, your vision, and your legacy?

These aren’t soft metrics.

They’re the scoreboard of a life well-designed.

And if your business doesn’t give you time for these — what’s it really giving you?

Time is where burnout begins.

But it’s also where true freedom becomes visible.

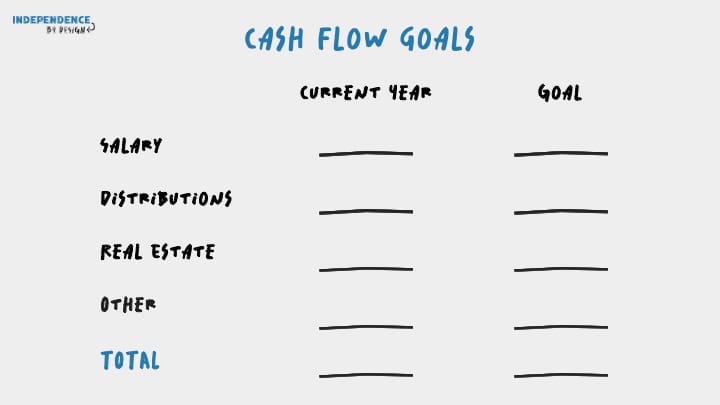

Cash Flow: Strategic Flexibility

Cash Flow makes up 30% of your Score — because it funds every strategic decision you make.

This isn’t just about profit.

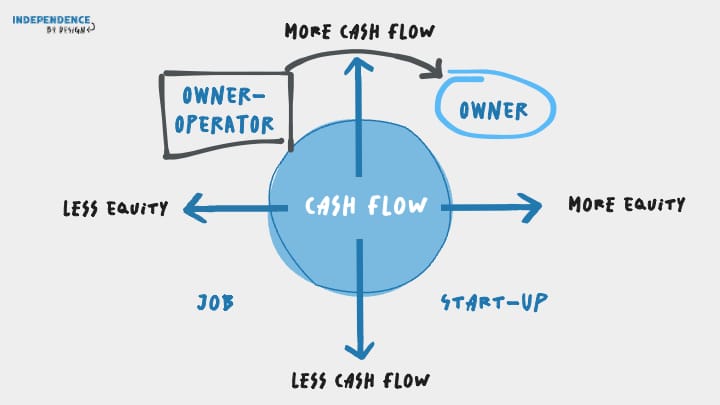

It’s about how confidently you decouple your time from your cash flow.

We measure four sources:

W2 Compensation → What you earn for the roles you still play

Distributions → What you take as an owner when value is created

Real Estate → What your investments generate outside of active work

Other → Other forms of income

The real question isn’t “Are you making money?”

It’s “Is that money giving you leverage — or do you have ?”

When your cash flow is unpredictable, every decision feels risky:

You hesitate to hire

You delay distributions

You hoard cash or overextend

And you can’t tell if growth will fund freedom — or swallow it

But when cash flow is healthy and predictable?

You get to move from operator to owner.

You can:

Take home what you actually deserve — not just what’s left over

Reinvest with precision — not hope

Say no to the wrong customers or projects — without flinching

And sleep at night — because you’re running the numbers, not running scared

Cash flow gives you control over your present — and fuels your ability to build the future.

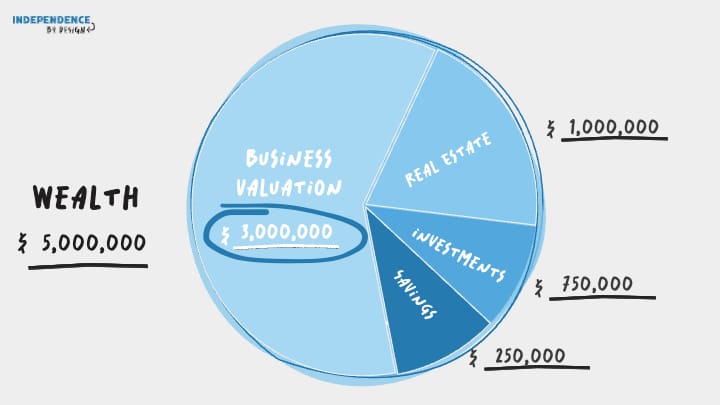

Wealth: Long-Term Leverage

Wealth makes up 20% of your Score — not because it matters least, but because it matters last.

It’s the most misunderstood part of ownership.

And often, the most neglected.

Most owners don’t start thinking about wealth until they’re thinking about an exit.

But wealth isn’t just about someday — it’s about having leverage today.

Your Wealth score measures how much real, transferable value you’re building — value that exists beyond your involvement in the business.

That includes:

Business valuation → Normalized EBITDA × multiple, plus net debt, minus working capital

Equity in real estate, investments, and other private assets

Liquidity readiness → Can this equity be used, converted, or leveraged when you need it?

Wealth is what turns success into freedom.

It’s the difference between owning a job and owning an asset.

The trap?

You can spend years building a valuable company, but if that value is trapped inside your personal role… it’s not really wealth. It’s risk.

When Wealth is working, you have:

Real options → Sell, recap, transfer, or keep building

Reduced pressure → You’re not relying on the business for survival

A future that serves you — not one that requires you to keep showing up

Wealth isn’t a finish line.

It’s a freedom amplifier — the lever that unlocks your next season, on your terms.

Your iBD Score: The Real-Time Measure of Owner Independence

The iBD Score is your personal independence index — a single number that reflects how close you are to full Owner Optionality™.

It’s not about revenue.

It’s not about headcount.

It’s about leverage — how well your business is serving your time, cash flow, and wealth goals.

This Score is calculated by measuring your progress toward three target outcomes:

Dimension | What It Tracks | Weight |

Time | How much of your week is truly yours — not claimed by the business | 50% |

Cash Flow | How predictably does your business fund your lifestyle and strategy | 30% |

Wealth | How much transferable value you’re building for the long term | 20% |

Each area includes:

Your Current State

Your Future Goal

A Progress % — calculated based on how far you’ve come toward your definition of freedom

The Scorecard then weights those percentages and outputs your iBD Score — from 0% to 100%+.

And that number?

It tells you how close you are to the future you actually want.

The higher your Score, the more optionality you’ve designed into your business — and your life.

Why the Weighting Matters

Time gets 50% — because it’s the most emotional, constrained, and revealing indicator of independence.

Cash Flow gets 30% — because it funds your present and unlocks strategic action.

Wealth gets 20% — because it’s your long-term leverage, but only meaningful if you survive the journey.

This weighting system isn’t philosophical.

It’s practical — and it mirrors what real owners actually wrestle with.

Time is where the pain starts.

Cash flow is where risk shows up.

Wealth is what determines your future options.

From this score, we map every owner to one of six stages — not based on where you want to be, but where you actually are.

And that’s where we go next.

The Six Stages of Ownership

As your Score improves, you progress through six clear stages:

iBD Score % | Stage | What It Feels Like |

<25% | 🛠 Operator | You're in the weeds, doing it all yourself |

25–49% | 🚀 Escape Artist™ | You’ve taken the red pill and see the path |

50–74% | 🧱 Builder | You’re installing systems and gaining traction |

75–89% | 📐 Architect | You’re aligning strategy to ownership |

90–99% | 💪🏼 Freedom Fighter | You’re close — fine-tuning for true freedom |

100%+ | 🎯 Owner Optionality | You’ve decoupled time, cash, and wealth — and have full design freedom |

These aren’t revenue tiers.

They’re alignment markers.

How close are you, and what type of progress are you making, towards your goals.

They tell you whether the business is serving your life — or still running your calendar.

How the Scorecard Works in Practice

You’ll enter:

Time % → What % of your week do you truly control?

Cash Flow → Total of W2, distributions, and passive income

Wealth → Valuation, investments, real estate

Then define your freedom targets:

How aligned are you with how you spend your time?

What cash flow do you need annually to fund your lifestyle?

What’s the target valuation to hit your wealth goal?

The Scorecard calculates the gap — and gives you your Score.

More Than a Tool — It’s Your Compass

This isn’t just a one-and-done exercise. It becomes a living playbook that integrates into an Ownership Rhythm™ outlined in the Drive Strategy Module:

Monthly Ownership Meetings → Are your decisions closing the gap

Quarterly Game Plan → Every 90-day plan ties back to your Scorecard

Annual Planning → Does this year align with your Time, Cash, or Wealth goals?

Because you’re not just growing a company.

You’re tracking your independence in real time.